- #Should tax forms be stapled how to

- #Should tax forms be stapled pdf

- #Should tax forms be stapled update

- #Should tax forms be stapled verification

Include your Social Security number and tax year on the check. When submitting payments for electronically filed returns, do not send a copy of your return. If your tax bundle is too thick for a single staple or paperclip, use only Staples and as few as possible. Check the appropriate box on Form 740 or Form 740-NP when Form 2210-K is attached. Every page needs to be scanned into the system for processing so ideally 1 staple is recommended. When applicable, use Form 2210-K to calculate any underpayment of estimated tax penalties, underpayment of estimated tax interest, or to claim an exception to the penalty. I-20 forms (for F-1 students) or DS-2019 forms (for J-1 students), I-94 record (white card. Only clip the form to the top page of your tax return, not all of. You can also use a paper clip to attach the W-2 to your return. If city (local) tax was withheld from your pay, you will file this form. Place the W-2 on the right-hand side of the top page of your tax return and staple the W-2 in the middle so the IRS employee can quickly see your name and Social Security number without having to remove your W-2. Generally, those with no US income do not need to file this form. Direct deposit is available for those filing Form 740 only. Questions about the city/local form should be directed to Jordan Tax Services or the City Department of Finance. If you are filing electronically and request that your refund be direct deposited, be sure to verify that all account and routing numbers are current. Electronically filed returns must have the Credit for Tax Paid to Another State worksheet completed and submitted with the electronic submission for proper processing. Paper returns must include copies of other state(s) returns if claiming a credit. K-1s, 8863-K, Schedule ITC, federal tax forms, etc.) Make sure all appropriate schedules and worksheets are attached to the return (i.e. Processing of amended returns is from four to six months. Please include corrected Kentucky and/or federal forms, schedules, or W-2s. Use the proper form for the year you are amending and include a complete explanation of the changes.

#Should tax forms be stapled update

If you move after you have submitted your return, please contact the Department of Revenue to update your address. Make sure the address entered on the return is the correct address.

#Should tax forms be stapled verification

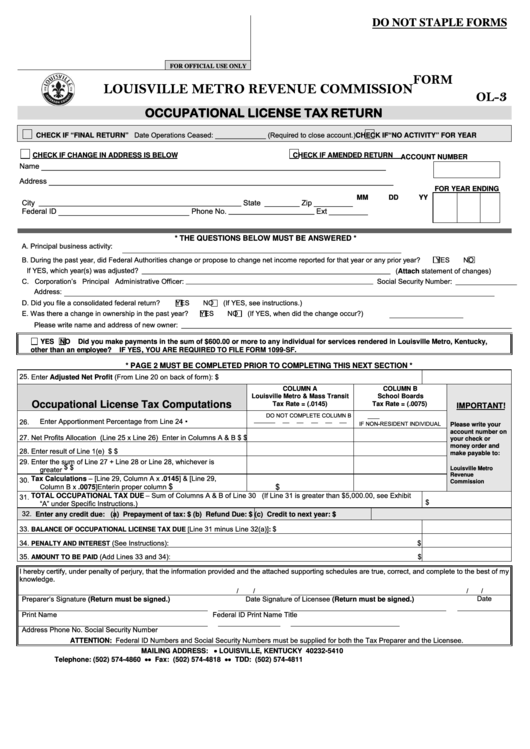

Please do not staple or bind mailed documents.Even though some W-2 information is included, Schedule KW2 needs to be attached for verification of withholding claimed. To assist in prompt processing, please ensure that all required tax forms and payment vouchers are included with a separate check for each tax form and you are filing using your MUNIRevs account number. of Form W3 ( is Blank)2 Part DO NOT STAPLE Signature Title Date Telephone number Department of the Treasury Form W-3 Transmittal of Income and Tax Statements 1992 Internal Revenue Service Note: Extra postage may be necessary if the report you send contains more than a few pages or if the envelope is larger than letter size. There may be significant processing delays before filings and payments are reflected in the user’s MUNIRevs account if you choose to file via paper. Please ensure that each return is completed with a separate voucher form, separate check/money order/cashier’s check payment, and mail to the address on the form.

#Should tax forms be stapled pdf

If you prefer to file on paper, or need to file an amended return, please use the fillable PDF documents located in the Document Library below. Staple the following items to your tax return in the order and location. Is the main method of communication between the City of Eugene and registrants. Failure to staple required items to your tax return.

/2019/05/11/4be55efe-0c75-43b6-bf7d-6358141a3a69/4be55efe-0c75-43b6-bf7d-6358141a3a69.jpg)

We strongly encourage the use of MUNIRevs to ensure accurate and timely filing of the payroll tax returns.

#Should tax forms be stapled how to

How to file / Register for a MUNIRevs Account

0 kommentar(er)

0 kommentar(er)